We’re back with a fresh batch of updates designed to make payroll even more accurate, flexible, and hands-off.

From smarter handling of historical workers to better support for mixed pay rates and irregular pay frequencies, these changes are all about giving your platform more control with less overhead.

Manage historical workers with ease

When employers migrate from a previous payroll provider, they may have workers in their past payroll records – like W-2s or 1099s – who aren’t active anymore and never made it into your platform. These are historical workers, and they’ve traditionally required a lot of manual setup.

To simplify this, Salsa now lets you programatically create historical worker records during onboarding.

Here’s how it works:

- Salsa will send the standard Worker.created webhook when this happens.

- The webhook now includes termination fields so your system can identify these workers as historical:

- externalId: Will be null (since they weren’t added via your system)

- terminationDate: The worker’s last day

- terminationCategory: Will be HISTORICAL

- externalId: Will be null (since they weren’t added via your system)

You can listen for this webhook, automatically create the worker in your platform, and send back the externalId – keeping everything in sync.

Why this matters:

- No more time-consuming back-and-forth during onboarding

- Historical workers get tied to your platform correctly

- Faster employer onboarding with fewer manual steps

- Ensures proper delivery of tax forms like W-2s and 1099s

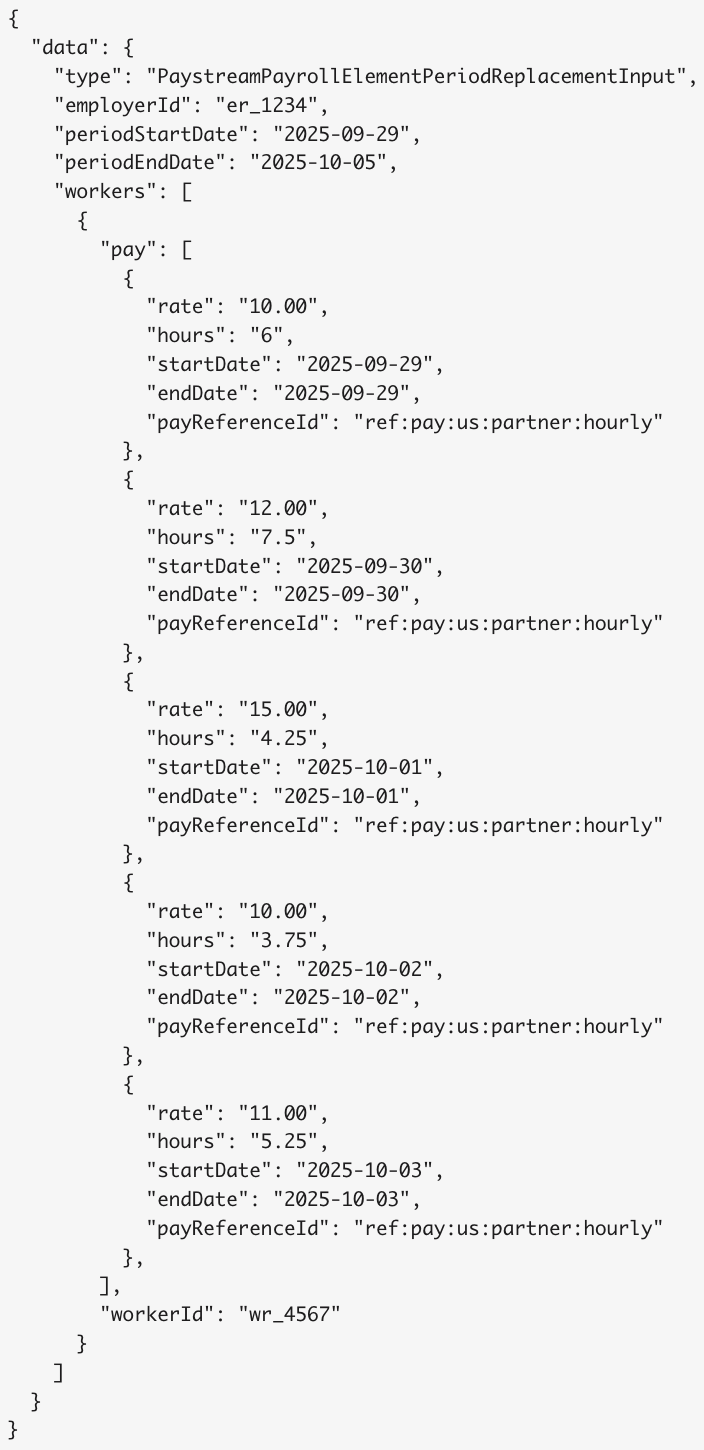

Multiple pay rates? No problem.

We’ve improved how pay entries are handled when workers earn different rates for the same type of work across different shifts. In this scenario, the system calculates a blended rate. With this change, we continue to offer the most flexible gross-to-net calculator, which allows platforms to send us the gross input for payroll at any granularity. This reduces the amount of data manipulation that your developers have to deal with.

This feature allows Salsa to support a more diverse range of professions where workers get paid different rates for different types of work.

- Workers with multiple job roles

- Variable rate contracts

- Complex pay structures where rate accuracy is critical

And when paired with our overtime engine, it’s smooth sailing – no need for manual adjustments.

Irregular Pay Frequency: More flexibility for shift-based work

Some industries don’t run on a neat weekly or biweekly payroll cycle. To support these cases, we now offer Irregular Pay Frequency as a payment group type.

This allows your platform to support single-day pay periods for your customers, using the correct daily tax tables for federal and state income tax.

Key details:

- Enable at the partner level: You decide whether this option is available. Contact Customer Success if you would like this feature enabled for your platform.

- Single-day runs only: Perfect for hospitality, staffing, healthcare, and other project-based industries.

- Accurate tax calcs: Uses official daily FIT and SIT tables.

- Selective payouts: Your customers can choose which workers to pay in each run – you control if and when this option appears.

Your users get the flexibility they need; you keep full control over how and when it’s used.

That’s a wrap!

These updates are all about reducing friction, improving accuracy, and making it easier to support complex payroll scenarios with confidence.

💡 Want to dive deeper into any of these? Reach out or check the docs – we’re here to help.

Stay in the know

Sign up to receive regular product updates highlighting our feature announcements and product enhancements.

.png)

.png)

.png)